| millions of € | 2024/25 | 2025/26 | 2025/26 | 2025/26 |

|---|---|---|---|---|

| millions of € | Group Results | Group Forecast | Forecast Steelmaking | Forecast Plantmaking |

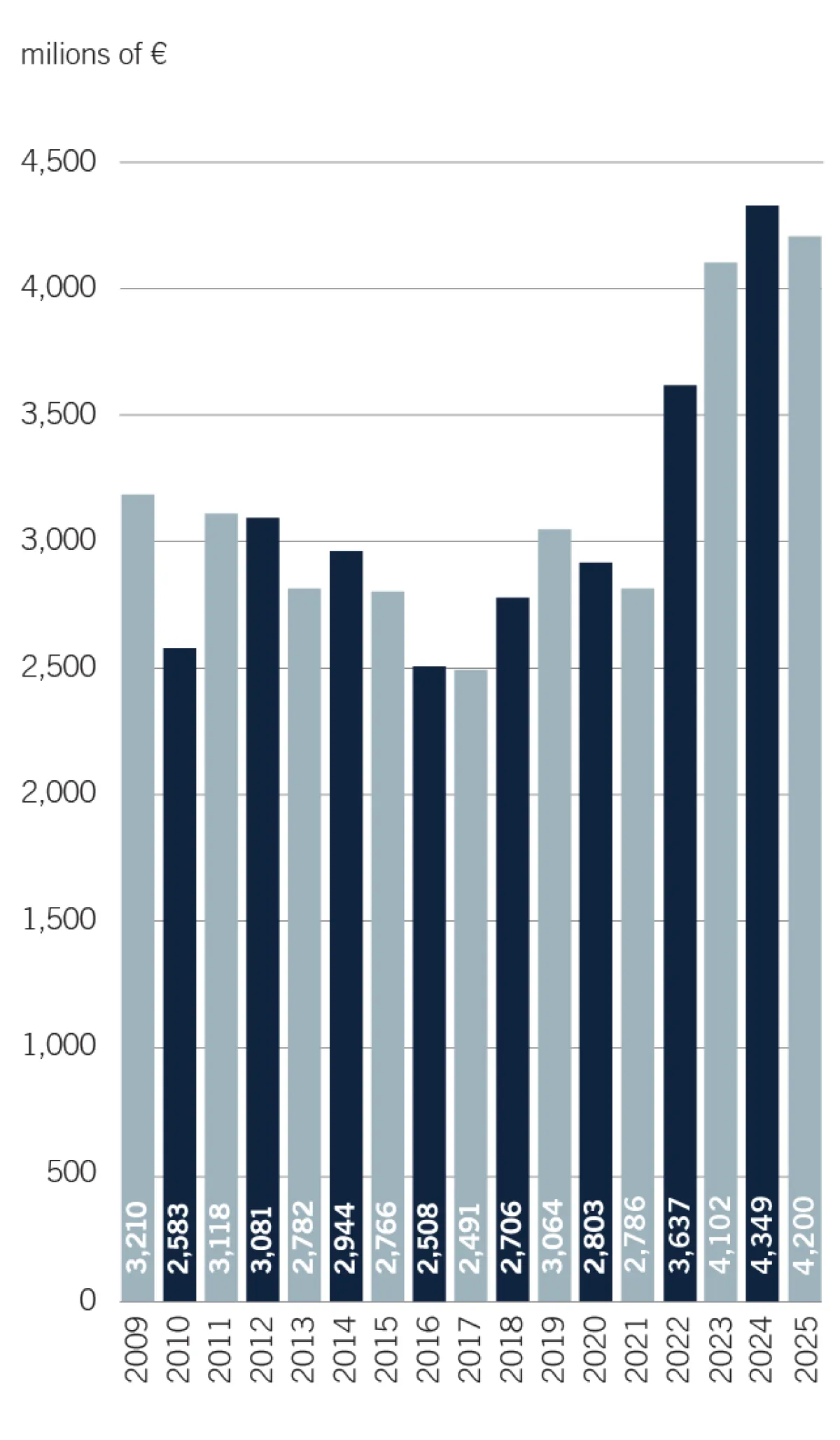

| Revenue | 4,200.0 | 4,100/4,300 | 1,100/1,200 | 3,000/3,100 |

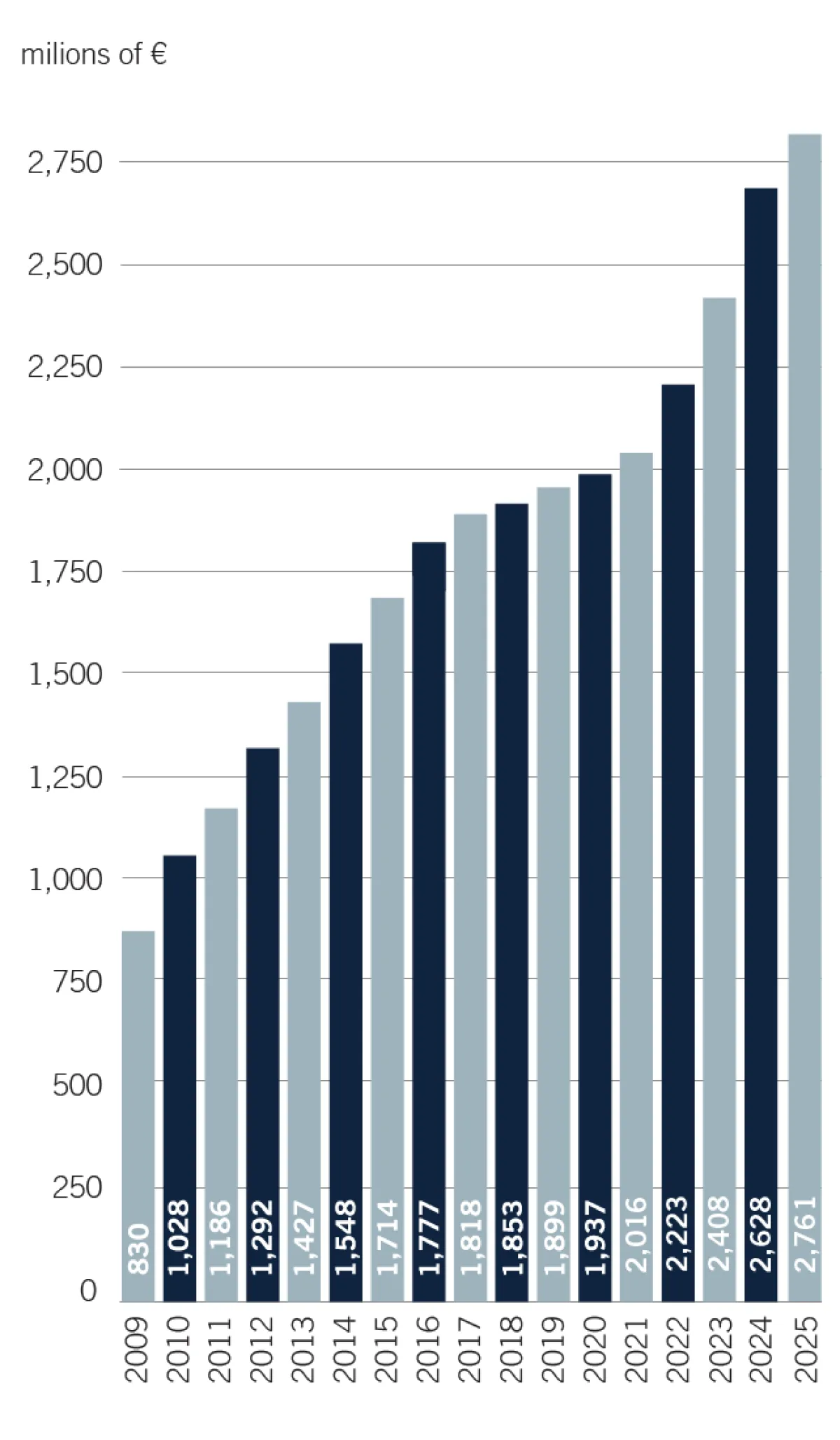

| EBITDA | 437.8 | 410/450 | 70/90 | 340/360 |

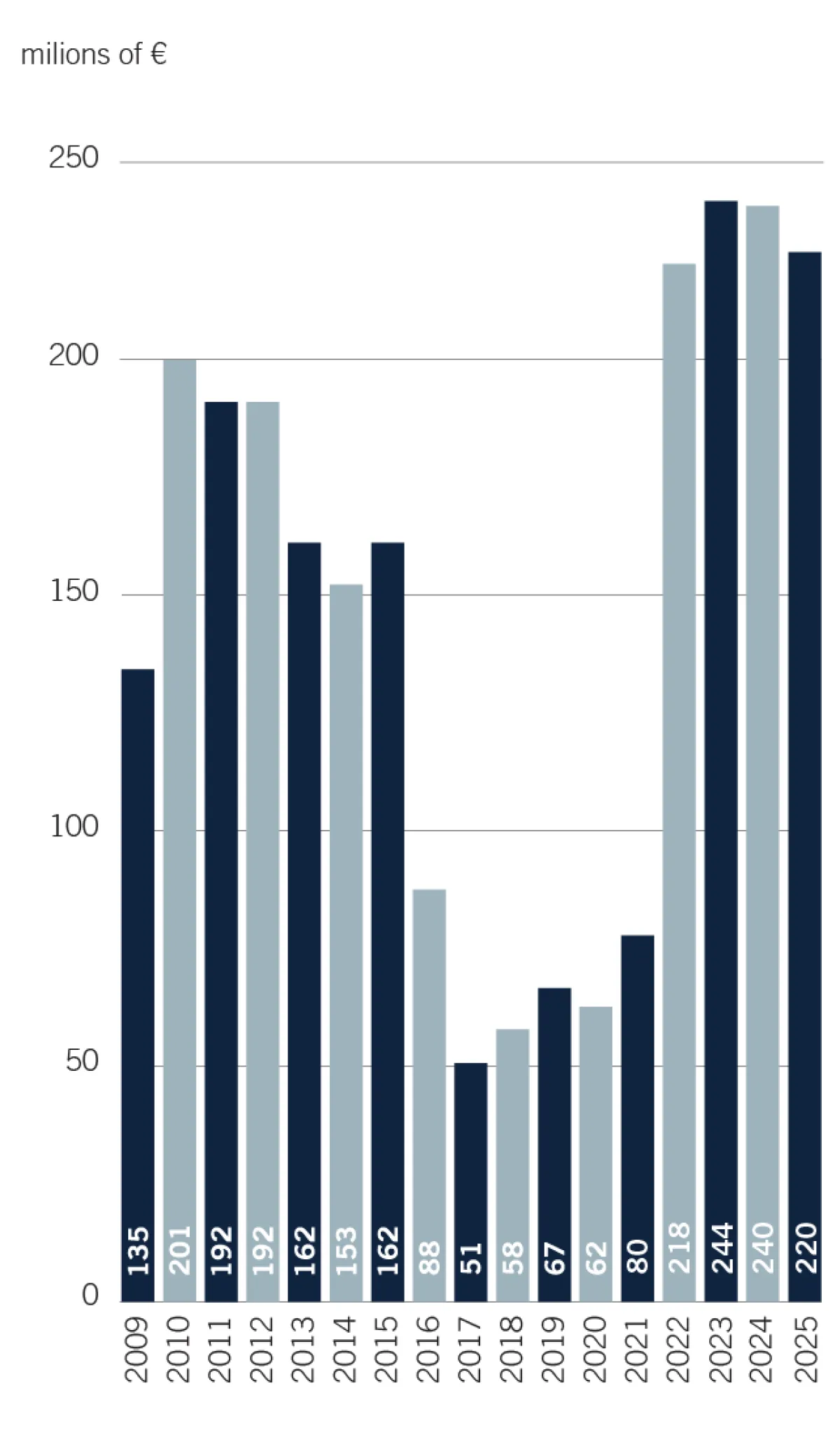

| Order backlog | 5,384 | 6,000/6,250 | 300/350 | 5,700/5,900 |

| 2024/25 | 2025/26 | 2025/26 | 2025/26 |

|---|---|---|---|

| Group Results | Group Forecast | Forecast Steelmaking | Forecast Plantmaking |

| Revenue | |||

| 4,200.0 | 4,100/4,300 | 1,100/1,200 | 3,000/3,100 |

| EBITDA | |||

| 437.8 | 410/450 | 70/90 | 340/360 |

| Order backlog | |||

| 5,384 | 6,000/6,250 | 300/350 | 5,700/5,900 |

| millions of € | |||