| millions of € | 2023 / 24 | 2024 / 25 | 2024 / 25 | 2024 / 25 |

|---|---|---|---|---|

| millions of € | Group Results | Group Forecast | Forecast Steelmaking | Forecast Plantmaking |

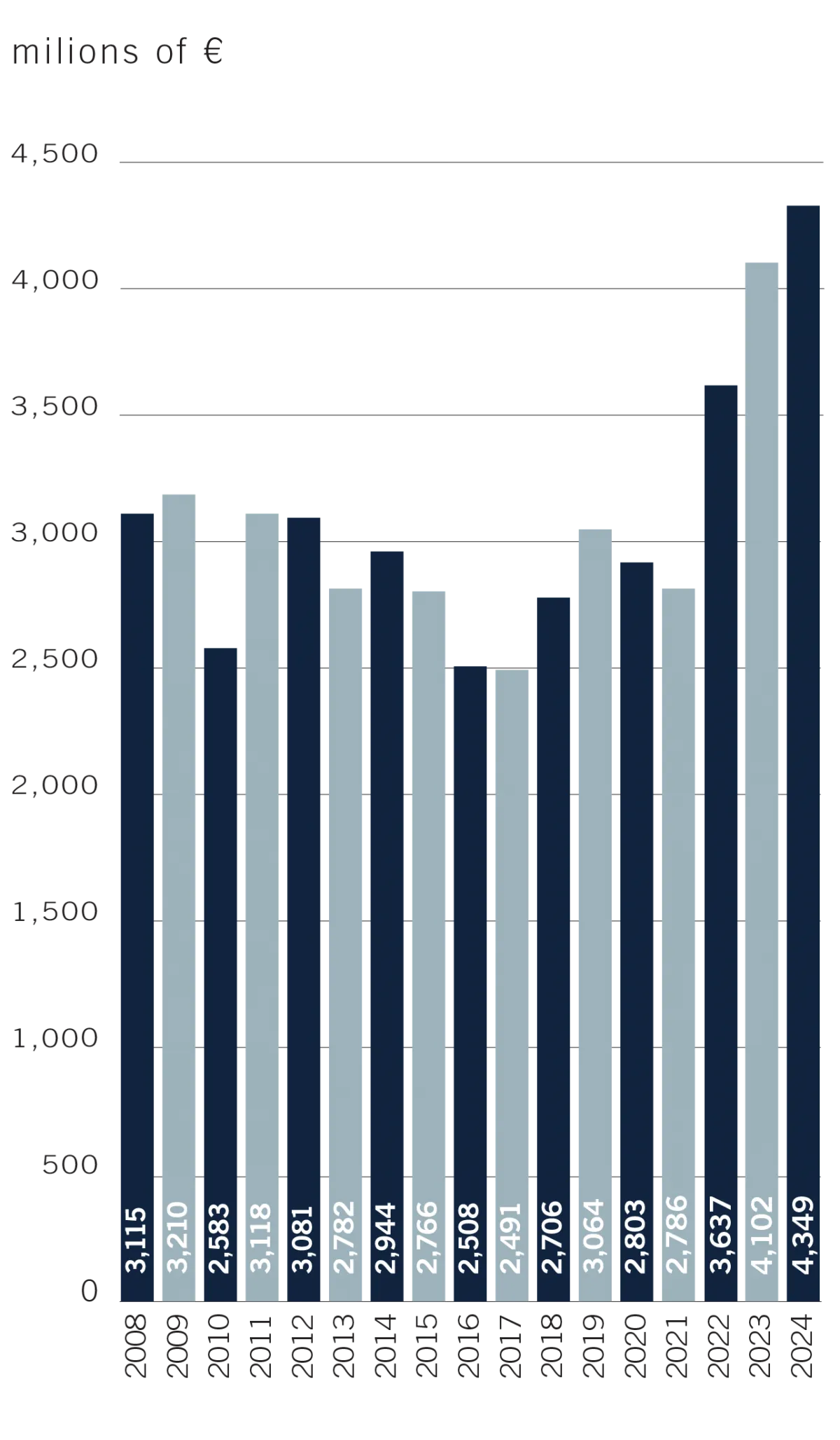

| Revenue | 4,349.8 | 4,000 / 4,200 | 1,150 / 1,250 | 2,750 / 2,950 |

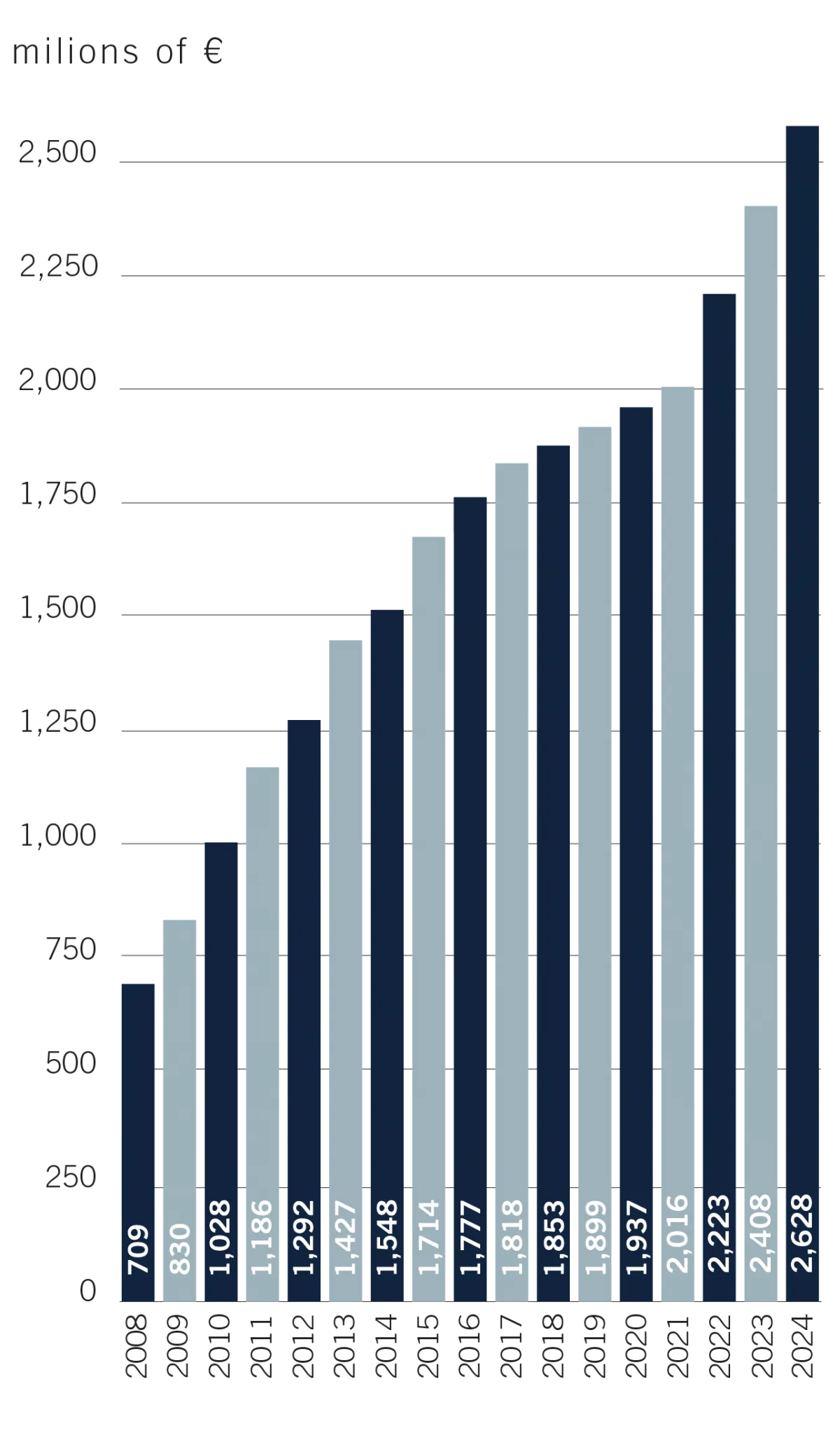

| EBITDA | 391,2 | 380 / 420 | 75 / 95 | 295 / 325 |

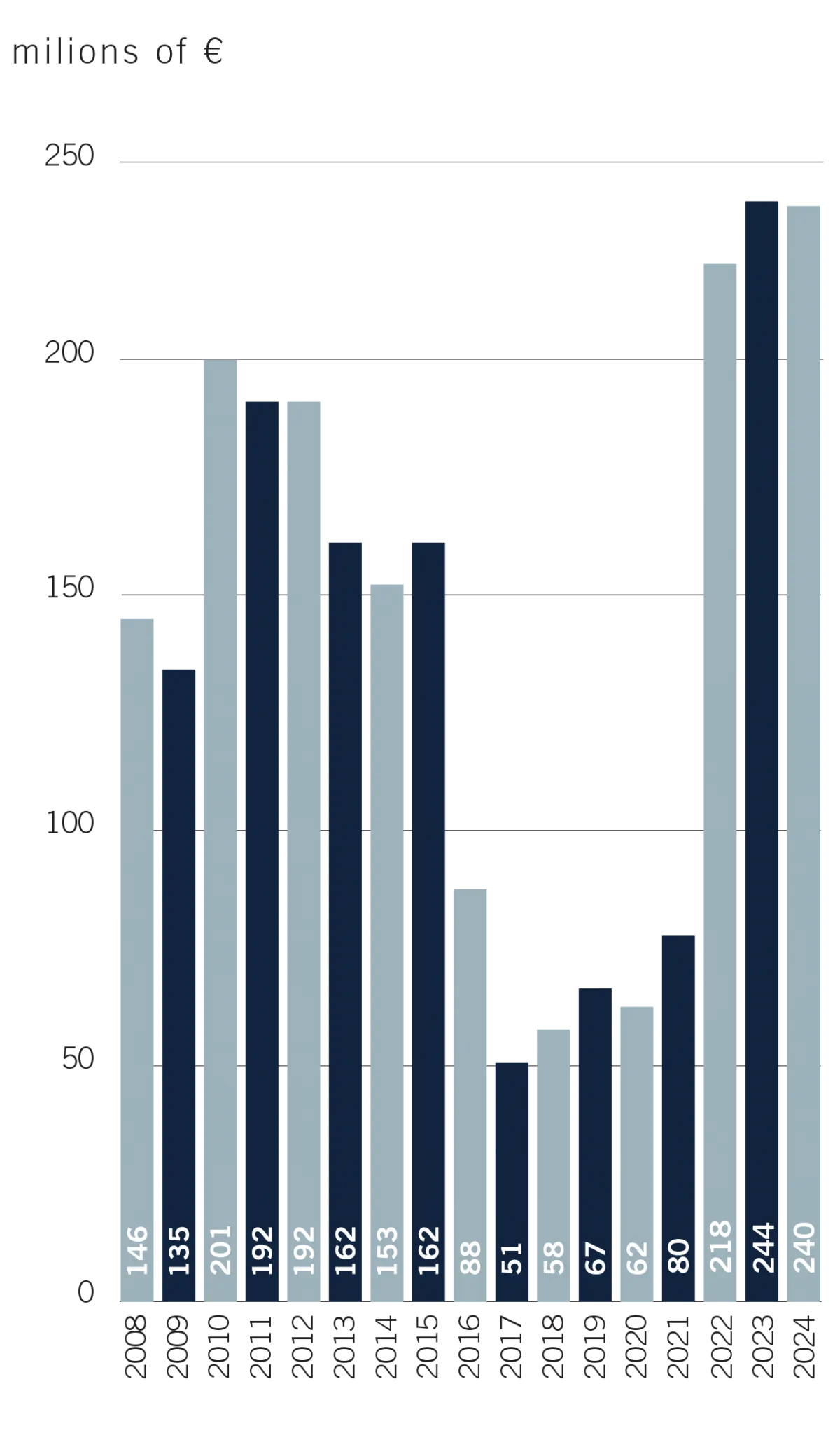

| Order book | 5,751 | 6,000 / 6,200 | 300 / 350 | 5,500 / 6,000 |

| 2023 / 24 | 2024 / 25 | 2024 / 25 | 2024 / 25 |

|---|---|---|---|

| Group Results | Group Forecast | Forecast Steelmaking | Forecast Plantmaking |

| Revenue | |||

| 4,349.8 | 4,000 / 4,200 | 1,150 / 1,250 | 2,750 / 2,950 |

| EBITDA | |||

| 391,2 | 380 / 420 | 75 / 95 | 295 / 325 |

| Order book | |||

| 5,751 | 6,000 / 6,200 | 300 / 350 | 5,500 / 6,000 |

| millions of € | |||